4 New Studies Show Obamacare Is Working Incredibly Well

By Jonathan Chait, New York Magazine, Dec. 4, 2014

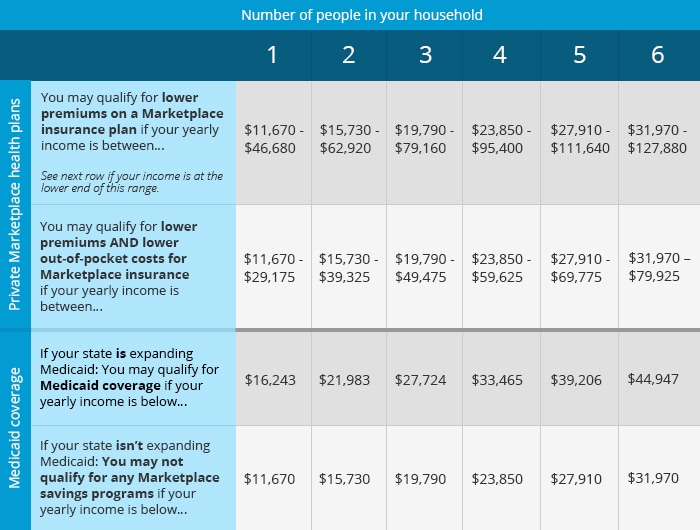

The overall goal of the law was to gradually reverse the two most perverse facts about the U.S. health-care system: Its overall cost has exploded, and it denies access to tens of millions of people. Four major new sources of information have come out this week, all of which have further demonstrated the law’s success.1. Increasing access to the uninsured. The law was never going to ensure that every single American had insurance. President Obama promised, in the face of political pressure, not to extend its coverage to non-citizens, who make up about one fifth of the uninsured population. The Supreme Court decided to allow states to boycott the law’s Medicaid expansion, adding some 4 million more to the ranks of the uninsured. Also, any new law takes years to ramp up participation and public awareness.

Conservatives widely denied that the law would even succeed at its basic goal of increasing access to health insurance. Obamacare “created more uninsured people than it gave insurance to. And it promises to create even more,” argued National Review’s Jonah Goldberg. Fox News panelist Charles Krauthammer proclaimed the law would result in “essentially the same number of uninsured.”

Every serious method of measuring has shown the law effecting significant reductions in the uninsured rate. Continue reading “The Affordable Care Act is a Stunning Success”